The YWCA National 403(b) Plan from Mutual of America lets you supplement your retirement savings with pre-tax contributions.

Personal Savings and Retirement

For YWCA employees, retirement savings can be thought of as a three-legged stool: YWCA Retirement Fund pension, Social Security, and personal savings. Whatever gap remains between retirement needs and the first two sources of income must be made up by personal savings.

Did you know: approximately 50% of women ages 55 to 65 have no personal retirement savings and an even smaller percentage of women have over $100,000 in retirement savings (34.2%)? *according to data from the U.S. Census Bureau

Optional Employee Contributions

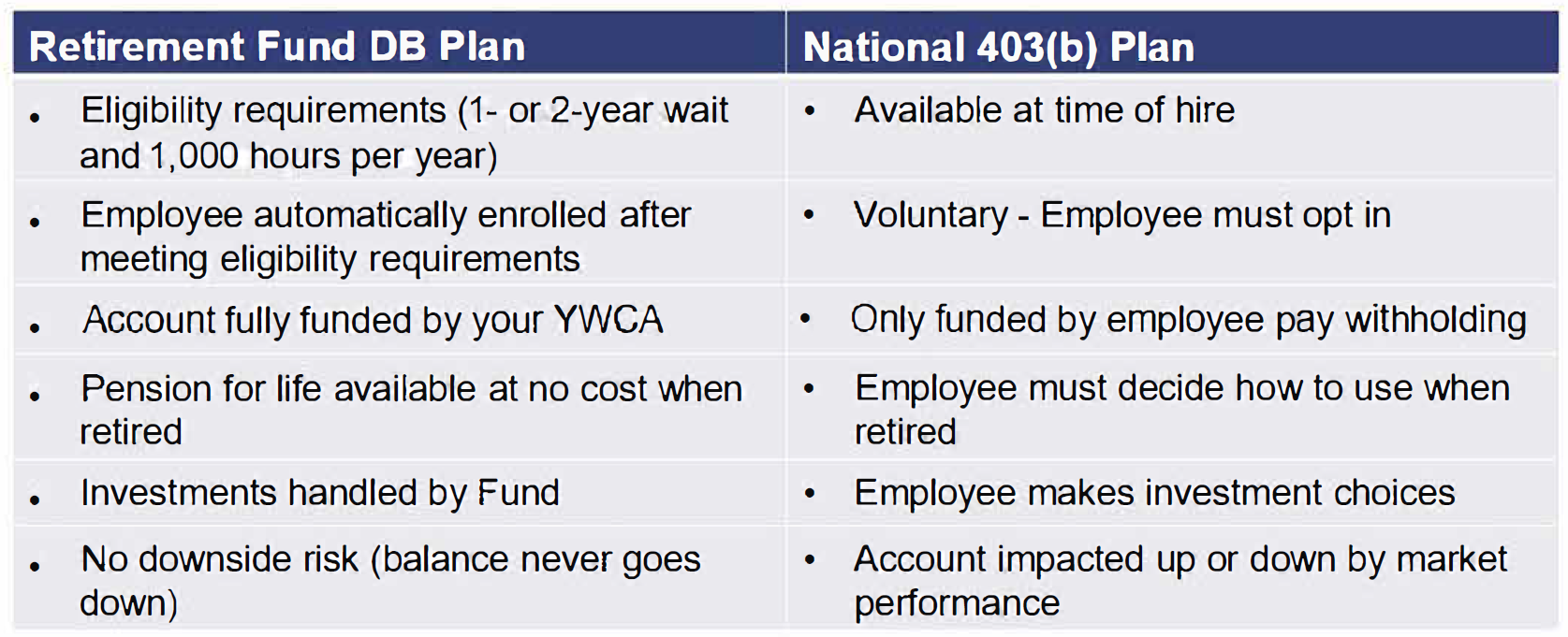

The YWCA Retirement Fund is a cash balance defined benefit plan and therefore prohibited by the U.S. Department of Labor from accepting pre-tax optional contributions from participants. However, Fund participants may choose to make optional after-tax contributions through monthly payroll deductions.

Mutual of America: 403(b)

The MoA National 403(b) Program allows YWCA employees to make both pre-tax and post-tax contributions to their retirement savings at no cost to associations.

At a Glance

To learn more about your YWCARF and YWCA National 403(b) savings options, watch this short video.

Contact

Participation in the National 403(b) Program is only available to employees of YWCAs that enroll in the program. Please contact your association's Human Resources department for more information.