The YWCA National 403(b) Plan from Mutual of America lets your employees supplement their retirement savings with pre- and post-tax contributions -- at no cost to your association.

Personal Savings and Retirement

For YWCA employees, retirement savings can be thought of as a three-legged stool: YWCA Retirement Fund pension, Social Security, and personal savings. Whatever gap remains between retirement needs and the first two sources of income must be made up by personal savings.

Did you know: approximately 50% of women ages 55 to 65 have no personal retirement savings and an even smaller percentage of women have over $100,000 in retirement savings (34.2%)? *according to data from the U.S. Census Bureau

Optional Employee Contributions

The YWCA Retirement Fund is a cash balance defined benefit plan and therefore prohibited by the U.S. Department of Labor from accepting pre-tax optional contributions from participants. However, Fund participants may choose to make optional after-tax contributions through monthly payroll deductions.

Mutual of America: 403(b)

YWCA has teamed up with Mutual of America (MoA) to increase the options available to each YWCA employee to save for retirement.

The MoA National 403(b) Program allows YWCA employees to make both pre-tax and post-tax contributions to their retirement savings at no cost to associations.

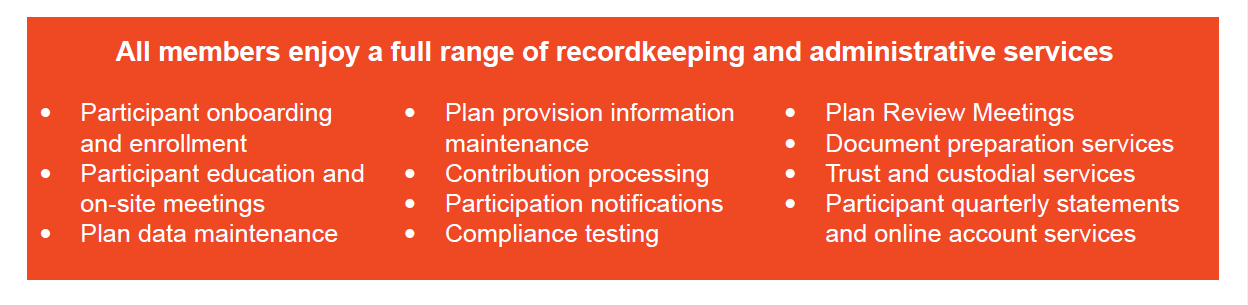

MoA is a women-focused financial services group that provides a comprehensive array of retirement services and investment options, including:

* Retirement Plan Set Up and Implementation

A dedicated services team will offer consultation and guidance.

* Financial Education

Through online and in-person education, your employees will discover the advantages of participating in the MoA plan and get information on asset allocation and income options.

* Simplified Plan Administration

Automated systems make it easy to manage your plan using minimal staff time and resources.

* Investment Fund Choice and Flexibility

Choose from pre-screened mutual funds that offer a variety of risk/return levels. You’ll be able to create a diverse investment lineup with the potential to help plan participants achieve their long-term goals.

* Flexible Fee Structure

You have the option to pay all or a portion of certain fees for your plan participants.

* Fiduciary Support Services

You gain access to a financial network of licensed professionals.

Capabilities and Support

You can enhance your employee benefits package quickly and easily. The plan offers:

* Streamlined administration

Even though the plan is used by multiple YWCA associations, it’s treated as a single, qualified plan under ERISA.

* Support for Existing Plans

If you have an existing retirement plan (additional to the YWCA Retirement Fund), it may make sense to merge it with the MoA National 403(b), subject to MoA’s underwriting guidelines and requirements.

* Financial Support

This plan provides a solution for your employees to save at any contribution level.

Contact

To discuss your association's participation in the National 403(b) Program, contact:

Helen Barnett Appel

Retirement Plan Specialist

Phone: (443) 410-7196

Email: helen.appel@mutualofamerica.com