How contribution rates impact the "replacement ratio" and the goal of a dignified retirement

As part of the YWCA organization, your association has committed to providing your eligible employees with an unparalleled benefit in regard to their ability to retire after dedicating their careers to the YWCA movement: participation in the YWCA Retirement Fund.

Your association makes an annual election of contribution rate to the Fund; this is the percentage of your participating employees' monthly compensation that is deposited into their Fund accounts, to which the Fund then provides a 40% match. Your association chooses one of the following contribution rates: 3%, 4%, 5%, 7.5%, or 10%.

Retirement Income: A Three-Legged Stool

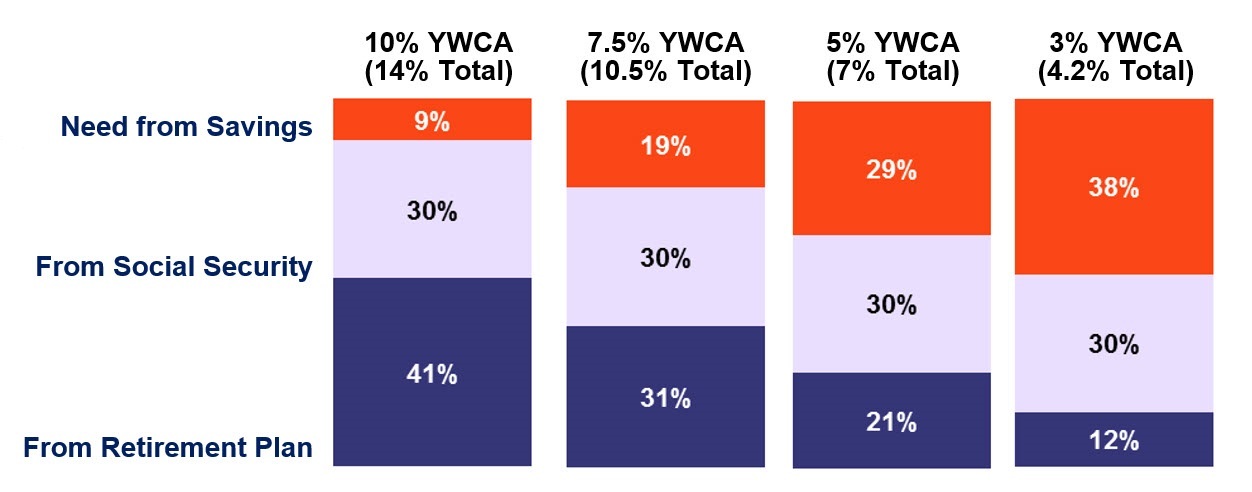

For YWCA employees, retirement savings can be considered a three-legged stool: YWCA Retirement Fund pension, Social Security, and personal savings. Whatever gap remains between retirement needs and the first two sources of income must be made up with personal savings.

Association Contributions and the Replacement Ratio

Replacement ratio is defined as income in retirement calculated as a percentage of a person's final year of pay.

While everyone's needs in retirement are unique, and many factors affect what an individual will likely require for retirement, experts agree that a recommended target is between 70% and 85%.

Within the YWCA network, where 2/3 employees make less than $50K annually, association contributions are vital to a secure retirement.

Within the YWCA network, where 2/3 of employees make less than $50K annually, association contributions are vital to a secure retirement.

This chart illustrates the effect on retirement readiness of your association's average contribution rate over a long-term YWCA career and, therefore, how much personal savings an employee would need to retire comfortably.

More Resources

For a fuller understanding of the YWCA movement's role in providing secure retirement for careers of service, watch the short video below.

You may download this information as a PDF here.