Securing your retirement with a fixed monthly payment for life

From the moment they are enrolled, all YWCA participants are fully vested in their Fund accounts. That means that they own their benefits in their entirety and are eligible upon leaving YWCA employment to receive them or roll them over to another employer's plan. While many former YWCA employees choose to leave their benefits with the Fund until age 73, where they will continue to accrue interest credits, inevitably the question arises someday: what kind of retirement distribution should I choose, a lump-sum refund or an annuity?

If you don’t think you are familiar with the term annuity, actually you are! Social Security and most traditional pension plans are structured as annuities, which means guaranteed payments for life. And within the private sector, insurance companies offer a variety of fixed and variable annuities – the main differences being how the annuity funds earn a return, and the associated risk with variables’ higher earning potential.

YWCA Retirement Fund offers six different types of fixed annuities, which vary based on how much - if at all - you would like to leave for a beneficiary after your death. And in contrast with many private-sector investors, the Fund simply converts your balance into a monthly annuity with no hidden fees or surcharges.

Annuities at a Glance

When weighing the benefits of a one-time payment of your account balance versus a monthly income that you cannot outlive, it’s important to consider the following:

- Protection from investment and market risk

- Increased longevity

Investment and Market Risk

Retirement Planning is not a “one size fits all” scenario. Each person’s retirement needs are unique. Only you can decide if a fixed monthly pension is preferable to investing in or purchasing another retirement vehicle. However, if safety and security of income in retirement is a key concern, it is hard to beat a Fund annuity for life. Your monthly pension would be protected from the ups and downs of the market, offering you unparalleled peace of mind.

Longevity

In 2022, the average YWCA retirement age was 69.6 years. This continues an upward trend from 2018’s 65.7 years, interrupted by a brief drop to 65.8 years in 2020 due to the impacts of COVID-19.

But while retirement age is trending up, so is life expectancy. According to the Centers for Disease Control and Prevention, median life expectancy for U.S. women is 79.3 years, which is even higher than the combined expectancy for both sexes, 76.4 years. The effects of COVID-19 continue to impact mortality data, but updated tables released by the Society of Actuaries in October 2022 point to a larger trend of increased longevity.

No one can predict the future, of course, but an annuity protects and ensures your retirement income from the day you retire until the day you die.

Why Select a YWCA Retirement Fund Annuity?

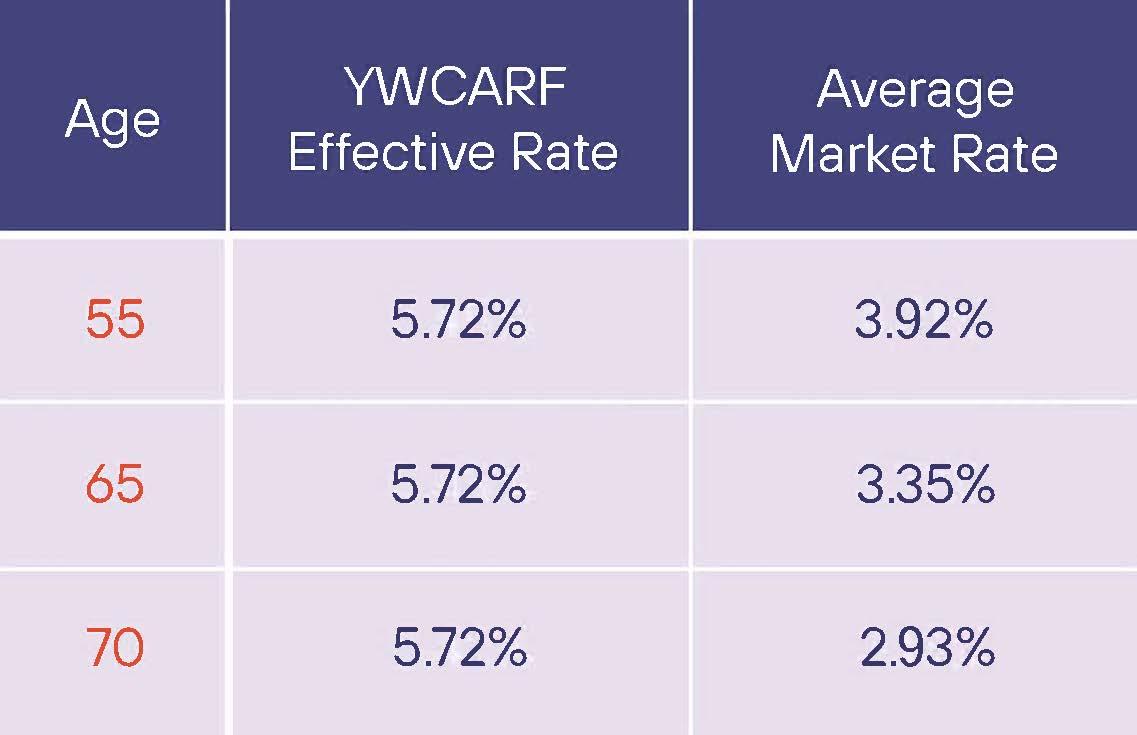

The Fund has consistently beaten the rates offered by the commercial market for fixed-life annuities. And unlike all commercial annuity providers, we do not charge fees for purchase. Here's how we measure up:

YWCARF Annuity Options

The Fund offers six annuity options for accounts with a balance of $5,000 or greater. Here's what you need to know to make the right decisions for yourself and those you care about down the road.

Annuities: Guaranteed Income for Life

Watch this video for more information on how Fund annuities are calculated and distributed.